Indicators on Trading Indicator You Need To Know

Wiki Article

A Biased View of Trading Indicator

Table of ContentsAbout Trading IndicatorWhat Does Trading Indicator Do?Some Known Details About Trading Indicator The Basic Principles Of Trading Indicator The Only Guide for Trading Indicator

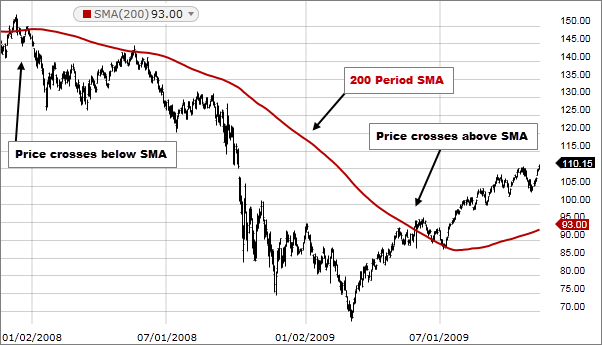

They have a predefined size for the variety of values to typical. This collection of worths moves on as more information is included with time. Offered a series of numbers and a fixed subset dimension, the very first component of the relocating typical collection is obtained by taking the average of the initial set subset of the number collection.Moving averages are understood to be delayed indications as they delay behind movements in the price/volume graphes. The lagging indicators exist since they are calculated by utilizing historic data. A faster moving average (brief term or short lookback duration) has less lag when contrasted to a slower moving average (long-term or long lookback duration).

Quick moving standards are additionally called smaller sized moving averages considering that they are less responsive to day-to-day rate adjustments. The cost of securities has a tendency to rise and fall swiftly, and also consequently, the graphs consist of several heights and troughs making it difficult to understand the total motion. But with moving ordinary trading, the moving standards aid smooth out the variations, enabling analysts as well as investors to anticipate the trend or activity in the price of securities.

Trading Indicator for Dummies

6 It can be seen that the part for determining standards progresses by one data entrance, as a result, the name moving standard (additionally called running ordinary or rolling average). A relocating average series can be calculated for whenever collection. Allow us currently see the example of relocating ordinary trading with a chart showing 10 day, 20 day and also 50 day relocating standard.It can be observed that the 50 day relocating average is the smoothest and the 10 day relocating standard has the maximum variety of heights and also troughs or variations. As the lookback duration boosts, the moving ordinary line moves far from the rate contour. The red line (10 day moving standard) is closest to heaven line (cost curve) as well as the purple line (50 day moving average) is farthest away.

Trading Indicator - An Overview

e., 17, Read Full Article 29,110, and so on and also the investor is totally free to adjust the time period based upon historical information evaluation. There are several kinds of relocating averages relying on the calculation of the averages. The five most typically utilized sorts of relocating averages are the easy (or arithmetic), the rapid, the weighted, the triangular and the variable moving average.Triangular averages use even more weight to data in the center of the moving average period. A basic (or math) relocating standard is a math relocating typical computed by adding the elements in a time collection and also splitting this total amount by the number of time periods.

All elements in the SMA have the exact same weightage. If the moving typical period is 5, after that each component in the SMA will certainly have a 20% (1/5) weightage in the SMA.The SMA is typically made use of to determine fad instructions, but it can also be made use of to create prospective trading signals.

The Facts About Trading Indicator Revealed

The exponential relocating standard is a kind of heavy relocating standard where the components in the relocating average duration are designated a tremendously enhancing weightage - TRADING INDICATOR. A linearly heavy relocating standard (LWMA), likewise generally described as heavy relocating average (WMA), is calculated by assigning a linearly enhancing weightage to the components in the relocating average duration.The sum read of all these linearly heavy elements will after that be added and split by the amount of the multipliers. When it comes to 10 components the sum will be divided by 55 (n(n +1)/ 2). The chart shown listed below plots the SMA (red line), EMA (green line) and LWMA (purple line) for a thirty days duration.

Yet it is a little slower to react to fluctuations than the EMA.The sluggish response to fluctuations is because LWMA lays slightly better stress and anxiety pop over to this site on the current previous information than the EMA. In the instance of EMA, the weights for every new data factor keep raising in a rapid fashion. Stated listed below are the weightage offered to aspects when computing the EMA and WMA for a 4 day period: Latest aspect: 2/(4 +1) = 40% 4/10 = 40% 2nd newest component: 40% x 60% = 24% 3/10 = 30% 3rd newest aspect: 24% x 60% = 14.

Facts About Trading Indicator Revealed

4% x 60% = 8. 6% 1/10 = 10% 5th latest aspect: 8. 6% x 60% = 5. 2% 0/10 = 0% sixth newest element: 5. 2% x 60% = 3. 1% 0/10 = 0% 7th latest component: 3. 1% x 60% = 1. 9% 0/10 = 0% As well as so on The easy relocating averages are in some cases as well simple as well as do not function well when there are spikes in the security cost.

Report this wiki page